The buying and selling of NFTs are currently in the hands of just a few traders, according to researchers. They also found a few factors — such as visual features and sales history — predict price.

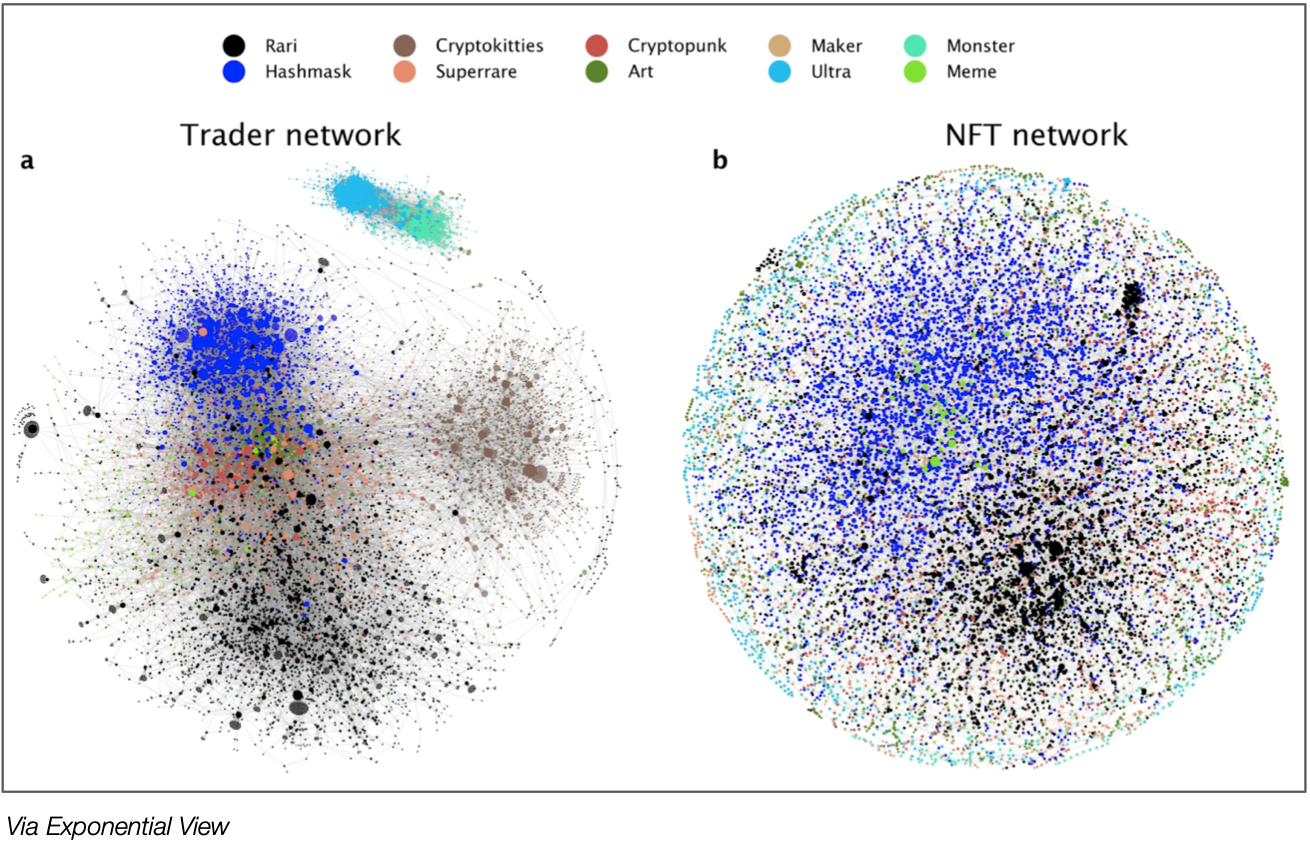

In a study, the team of City University of London-led researchers found a lopsided market for these non fungible tokens where about 10 percent of NFT buyer-seller pairs are contributing more to the total number of transactions than the remaining 90%. NFTs are digital assets — such as art, collectibles and in-game objects — that are traded online, often with cryptocurrencies, and typically encoded using smart contracts on a blockchain, according to the researchers.

The researchers, reported their findings in Nature, added that the market conforms to typical power-law dynamics.

Among other findings, the team reports that the price of an NFT is strongly correlated with the price of NFTs previously sold within the same collection and that visual features also affect price.

“We explored the predictability of NFT prices revealing that, while past history is as expected the best predictor, also NFT specific properties, such as the visual features of the associated digital object, help increase predictability,” the researchers write.

They also found that traders are highly specialize and that collections tended to be visually homogenous

To analyze the market, the researchers examined the market history of 6.1 million NFT trades across six main NFT categories. The categories include digital artworks, such as images, videos, or GIFs; collectibles, digital objects used in games, pieces of virtual worlds in the Metaverse; utility items that have a specific function and other collections.

Traders bought and sold about 4.7 million NFTs during the study period, from June 23, 2017 to April 27, 2021. The transactions involved a total of 359,561 buyers, 314,439 sellers and details of those transactions were obtained primarily from Ethereum and WAX blockchains.

To understand the data on those transactions, the researchers first characterized the statistical properties of the market and then built the network of interactions. They also clustered objects based on visual features. Sales prediction was based on the use of a machine learning algorithm that analyzed sales history.

According to the researchers, this is the first step in what they expect to stimulate deeper research into the NFT market, which is large — but expanding rapidly beyond NFTs use in online gaming.

The researchers write: “While NFT adoption in gaming has already reached a certain maturity, for example concerning the trade of in-game objects, different other industries, especially those involved with the production of digital content such as music or video, are experimenting with the technology. Overall, in the first four months of 2021, the NFT volume has exceeded 2 billion USD, ten times more than the entire NFT trading volume in 2020.”

The added: “We anticipate that these findings will stimulate further research on NFT production, adoption, and trading in different contexts.”

The team included Matthieu Nadini, Laura Alessandretti, Flavio Di Giacinto, Mauro Martino, Luca Maria Aiello and Andrea Baronchelli

For more market insights, check out our latest Digital Twin news here.