On November 8th, 2022, CZ, the CEO of Binance, announced that they were planning on acquiring FTX and had a non-binding LOI. This announcement shocked many onlookers to see Sam Bankman-Fried give up control of FTX to his most prominent competitor. As many readers know, this deal collapsed, and FTX filed for bankruptcy three days later.

Sam Bankman-Fried is no longer the CEO of FTX. Reports of mishandling client funds and making risky bets using Alameda Research have emerged. As of today, what happened to FTX is still a developing story as FTX, Alamada Research, SBF, and his close partners are being investigated.

On June 10th, I was in Austin, Texas, listening to Sam Bankman-Fried give a live interview during CoinDesk’s Consensus event. While at the event, it was evident that we were now in a bear market; many believed entities like FTX would stick around and are one of the more trustworthy organizations. However, in this packed hall of the Austin Convention Centre, I don’t think many would have believed that FTX would collapse before the end of the year as they sat to listen to SBF talk about the current state of crypto and other market occurrences. One important part of this interview was when SBF was asked if we are in a crypto winter. He said not necessarily as it depends on the overall market environment and what the industry is able to accomplish in the next 3 to 6 months.

This article attempts to trace the origins of Alameda Research and FTX. We will investigate which events led to one of the most popular and trustworthy centralized crypto exchanges collapsing. Lastly, being the Metaverse Insider, we will attempt to work out the repercussions of these events on the metaverse industry and the Web 3 market.

Origins of FTX and Alameda Research

To understand what went wrong, it is essential to understand the origins of Alameda Research and FTX.

Both FTX and Alameda Research were co-founded and funded by SBF. While it was well-known that both organizations worked together, the cooperation of both organizations and alleged misuse of customers’ funds has been recently discovered.

SBF was one of the co-founders of Alameda Research. He had recently left a global proprietary trading firm called Jane Street Capital. At Alameda Research, SBF famously organized an arbitrage trade where he may have earned more than 1 million dollars daily. He could exploit the crypto arbitrage that was presented as Bitcoin price was different in different exchanges around the world. When filing for bankruptcy, Alameda’s CEO was SBF’s friend Caroline Ellison.

SBF and Gary Wang co-founded FTX two years after Alameda Research. For two years, FTX grew quickly and attracted customers, celebrity endorsements, and public trust. The company was headquartered in The Bahamas and was planning on building a new HQ in the shape of the letter F.

While it was primarily known that both of SBF’s entities worked together, the magnitude of their collaboration was recently discovered.

Key Players

While many people and entities are involved in this complex case, some key players alongside SBF were brought up during the FTX debacle. While this is a non-exhaustive list, these people and entities help readers understand the complex web of FTX and Alameda Research. These personalities and connections also give a background of how FTX could cooperate with Alameda and stay under the radar for a long time.

Key People

Caroline Ellison: She was the CEO of Alameda Research. She worked with SBF at Jane Street before joining Alameda Research, and it has been alleged that she was also romantically involved with SBF.

Gary Wang: Gary is an MIT grad who assisted SBF in building Alameda Research and FTX. He was the CTO of FTX.

Nishad Singh: He was the head of engineering at FTX. According to this detailed article, Mr. Singh is one of the critical members of FTX who were aware of the arrangement between Alameda Research and FTX.

Key Entities

Sequoia Capital: Sequoia Capital has marked down its FTX investment of $210 million to $0, according to a report by CNBC. It has been widely reported that SBF played League of Legends while pitching FTX for funding to Sequoia Capital.

BlockFi: BlockFi is one of the many crypto companies that SBF had stepped to help as they were dealing with the crypto winter. Not long after the FTX bankruptcy filing, BlockFi is planning its bankruptcy procedures.

CoinDesk: It was at CoinDesk’s event Consensus, in June, earlier this year when I heard SBF talk about the bear crypto market. In November, the same publication began the domino effect that resulted in FTX’s demise. This was due to an article that exposed Alameda Research’s balance sheet holding a large amount of FTT Tokens.

Binance: Binance was FTX’s biggest competitor. As SBF realized that FTT Tokens’ devaluation would result in the collapse of FTX and Alameda Research, he agreed to a non-binding LOI with Binance to be acquired. As this deal fell through, so did FTX’s chances of getting rescued. Subsequently, FTX filed for bankruptcy.

Celebrities and Public Perception

While celebrities and endorsements may not be the decision-makers behind FTX, the influential personalities that put their name behind this exchange are being questioned for negligence. Tom Brady and Stephen Curry were both brand ambassadors and investors. Moreover, famous in the finance world and featured on Shark Tank, Kevin O’Leary often praised SBF. Surprisingly, in a recent interview, O’Leary said he would invest in SBF again. Celebrities and personals often seen on television continue to downplay these massive events. Recently, New York Times was criticized for a relatively “soft” article on SBF and mentioning he manages to get sleep despite the FTX fallout.

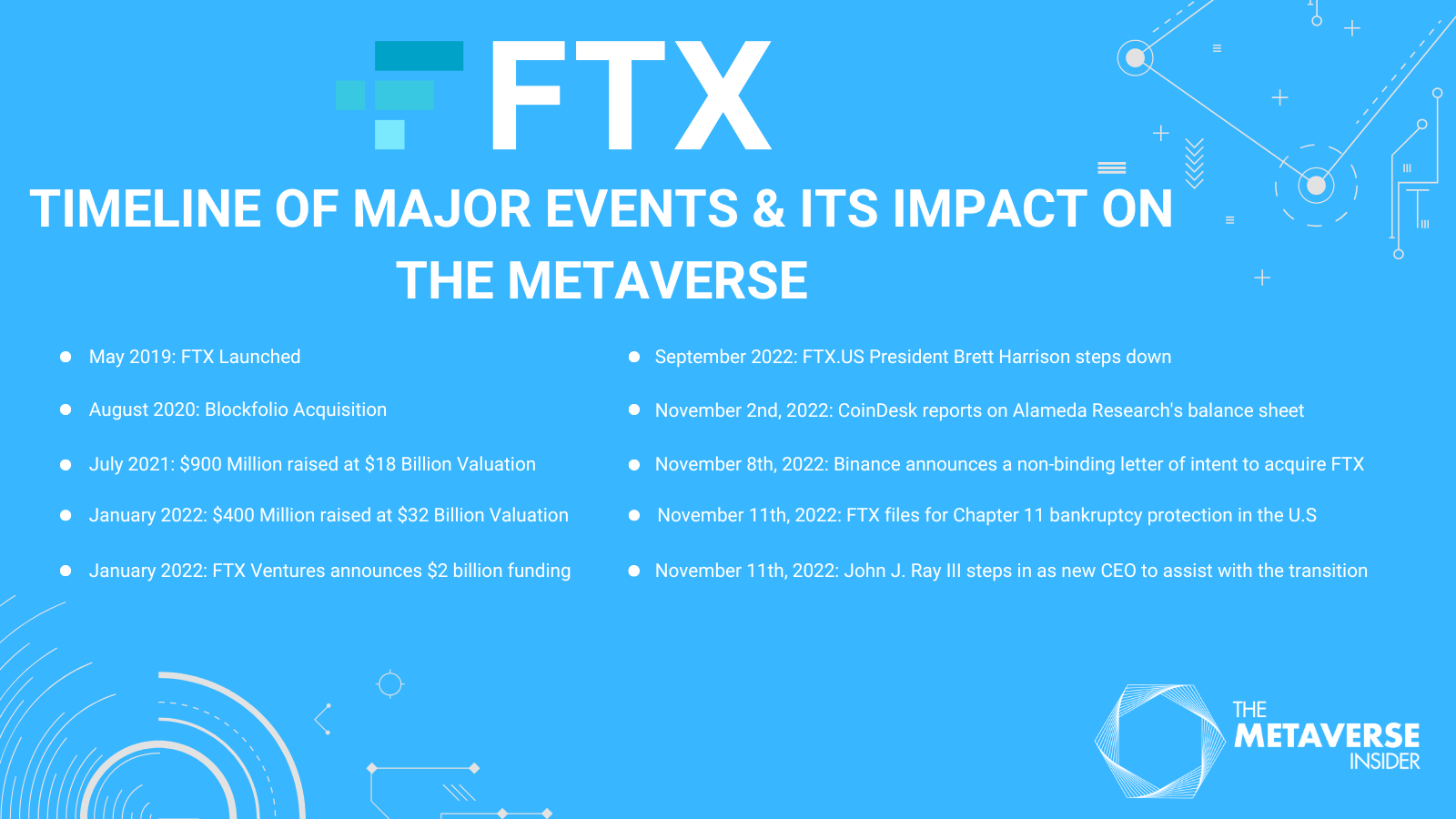

What went wrong – Timeline of Events

During the Bull market in 2020 and 2021, FTX was able to scale rapidly by growing its customer base and acquiring other companies. In August 2020, FTX made their first prominent acquisition as it acquiried Blockfolio, a cryptocurrency trading app, for $150 million.

By July 2021, FTX had a valuation of $18 billion as they raised funding from VC giants like Softbank and Sequoia Capital. Only six months later, FTX raised $400 million at a valuation of $32 billion.

At the start of 2022, FTX ramped up their investments and new offerings and investments into other crypto companies. FTX announced $2 billion fund called FTX Ventures. In February 2022, FTX.US started offering stock trading to their US customers. FTX continued to acquire during the bear market by helping struggling companies such as BlockFi.

By August, FTX was starting to show signs of struggling. Brett Harrison, president of FTX, implied FTX has FDIC insurance. The Federal Deposit Insurance Corporation retaliated by issuing a cease-and-desist letter accusing FTX of making false and misleading representations. SBF clarified that FTX does not have FDIC insurance and a month later Harrison stepped down as president.

However, most of the public only noticed something wrong earlier this month. On November 2nd, 2022, Coindesk reported FTX’s $8 billion in liabilities. After this report, Alameda Research purchased FTX’s FTT Tokens for $22 tokens. This may suggest that it was in Alameda’s interest to keep the FTT price at $22. Alameda has been involved in FTT since day one. How they were involved and to what extent has been a developing story as new research pieces seem to be coming out day-to-day.

As Nansen’s research indicated in their analysis of this debacle, Alameda seemed to be the only non-CEX identifiable entity interacting with FTX. It was as if, despite being different entities, both FTT and Alameda were functioning as one company, often exchanging information and funds to place risky bets with clients’ funds.

Another occurrence shows that Alameda and FTX were operating as almost one entity. FTX controlled over 80% of all FTT Tokens. All FTT Tokens and most unsold non-company tokens were deposited into a 3-year vesting contract, with an Alameda address as the sole beneficiary. One would assume that the beneficiary of this token should be FTX themselves.

Since Alameda and FTX owned most of the FTT Tokens, it is safe to assume that SBF & co. could easily manipulate the FTT token price. This also means that if one of these entities sold many FTT Tokens, it would significantly affect the other FTT Tokens.

Initially, FTX and Alameda did not have any issues. During the bull market, crypto prices continued to rise. At its highest, the value of the FTT token crossed $70. However, owning such a large share of FTT tokens, Alameda and FTX could not offload these tokens without negatively affecting the token value, which would, in turn, devalue Alameda and/or FTX’s balance sheets.

Thus, to address this issue, Alameda and FTX seemed to have used other ways to “take advantage” of this bull market. One of these ways was OTC trading. This was through trading FTT through a market maker (Genisis in this case). In September 2021, FTT transactions were recorded out of FTX and Alameda into Genesis Trading. Subsequently, there were many transfers from Genesis to FTX and Alameda wallets. Later on, Alameda sent many FTT Deposits to Genesis Trading wallet in December 2021.

Why would Alameda and FTX indulge in this? To simplify, FTX minted Alameda and circulated only a small amount of FTT in the market to ensure it is easy to move FTT prices and valuations through buying and selling on the market. FTX and Alameda collaborated to increase FTT prices by buying more FTT tokens to increase the token value even more. This allowed FTX’s and Alameda’s balance sheets to show a strong valuation. Also, this allowed Alameda to use FTT as collateral to make bigger (riskier bets) in the market by posting FTT as collateral. This strategy seemed to work well until the bear market hit.

In May/June 2022, the bear market had hit, and it was becoming evident with crypto prices falling, including Bitcoin and Ethereum. With the bear market, trading volume (and fees charged by FTX) dried up. This meant less revenue for FTX. But more importantly, Alameda’s investments became riskier as the collateral they had put for this loan (FTT Tokens) was worth much less. As market conditions worsened, creditors began to recall their loans.

As recalls began to increase, Alameda may have encountered severe liquidity issues. As crypto entities began to struggle, Alameda could have faced a liquidity crunch. According to Nansen’s report, Alameda received an inflow of FTT tokens in June to counter this liquidity crunch. This was the same time I had a chance to listen to Sam Bankman-Fried at Coindesk’s Consensus event. The crowd listening to SBF was utterly unaware of what was happening behind the scenes at Alameda and FTX. While the possibility of a crypto winter was brought up, the conversation focused on broader issues, including SBF’s political beliefs.

As Alameda faced a liquidity crunch, FTX came to the rescue. With the market conditions, FTX was the only entity willing to provide Alameda relief by providing liquidity. FTX turned to their users’ funds to provide these funds to Alameda. Thus, to help Alameda fund its VC fundings, FTX provided Alameda with an FTT-backed loan.

By October, the warning signs had become apparent. However, SBF continued to interview with different news outlets where he would talk about the bear market and his investments in struggling crypto companies. However, on November 2nd, 2022, CoinDesk reported that a considerable chunk of Alameda’s balance sheet was FTT Tokens ($5.8 billion out of $14.6 billion). Thus, Alameda relied heavily on the value of FTT tokens. This report does not include Alameda’s heavy liabilities; therefore, the severity of the situation was not reflected in this report. Four days after CoinDesk’s article, Alameda’s CEO announced that CoinDesk did not report over $10 billion worth of assets. However, the biggest blow to Alameda was not this article. It was yet to come from their biggest competitor, Binance.

On the same day, Alameda’s CEO tweeted, Binance CEO CZ announced they are liquidating all FTT tokens from their books. Alameda quickly offered $22/token in an OTC deal. At the same time, SBF stated that FTX and all their assets are fine. However, a massive amount of FTX outflow had begun in a day as FTT holders began to offload their tokens.

By November 8th, just 6 days after CoinDesk’s report, FTX gave in and Binance announced a non-binding letter of intent to acquire FTX. However, a day later, Binance walked away from the deal. By November 11th, after the deal with Binance had fallen through, FTX filed for bankruptcy, and SBF resigned as CEO.

This story is not over. There are a lot of questions that still need to be answered. For example, whether Alameda received funds directly from FTX cannot be conclusively answered by looking at the on-chain data alone. New revelations and accusations are being published online daily. So much so that it is almost impossible to keep up when one tracks what went on in the FTX and Alameda’s employees’ personal and professional lives.

There were warning signs as early as six months ago. SBF described yield farming to Matt Levine and the OddLots podcast. The host picked up on SBF’s description of yield farming and insinuated that SBF might be describing a Ponzi scheme. While many more prominent publications had ignored these warning signs, this claim by SBF was picked up by particular crypto enthusiasts online, including Stephen Findeisen, better known as Coffeezilla.

John Ray III, the current CEO of FTX, has made certain comments that have shocked many onlookers. Ray is a restructuring officer in many high-profile bankruptcy cases, including Enron. Thus, it came as a shock from someone who has overseen some of the biggest bankruptcy and corruption cases say, “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.” This also means that there are many more revelations to come.

Recently, it has been reported that SBF reached out the FTX employees with an apologetic letter. However, while the tone of the letter was apologetic, there were many questions left unanswered in the report including the misappropriation of client funds and many other revelations.

Impact on the Metaverse

Like the crypto market, the metaverse industry has endured some criticism. The losses incurred by Meta recently have led to the organization laying off more than 11000 employees earlier this month. These layoffs by Meta have been attributed to their Metaverse vision and investments in their Mixed Reality projects. Despite these negative headlines, the metaverse industry has remained optimistic about the future of this fast-evolving industry.

However, FTX’s downfall could be another massive blow to the Metaverse industry. The metaverse industry received negative headlines as it was discovered that FTX’s auditors’ HQ was in the Metaverse. The audited financial statements have been criticized and held responsible for their uninformed decisions. These headlines, the auditors’ HQ being in Decentraland, have also garnered some headlines.

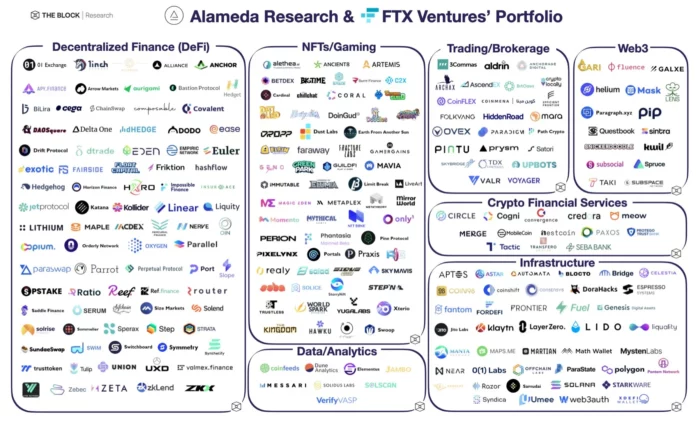

FTX Ventures invested in many Metaverse, Digital Assets, and Web3 entities. Thus, their demise will not only have an impact on FTX customers and the FTT token holders. This will impact their investments in the Metaverse and Web 3.0. The Block compiled a list of companies that received investment from Alameda Research and FTX Ventures.

Many of the above startups are included in the Metaverse Market Map. FTX Ventures and Alameda Research investments may have been profitable during the bull market until the end of 2021. However, during 2022 many NFT projects, infrastructure, and Web 3 projects have not performed as well as they may have in the previous two years. These bad investments undoubtedly contributed to the fall of FTX.

In late October 2022, I was at the Economist Metaverse Summit. I had an opportunity to meet many industry leaders and developers who were excited to develop the technologies, products, and services which will power the Metaverse. However, November has been a tough month for the Metaverse Industry. It remains to be seen how VCs and other investors will continue to build the technologies that power the Metaverse.

At the Metaverse Insider, we predicted that the growth would be slow over the next three years in our Market Sizing calculations. Indeed, Venture Capital funds will be affected by the fall of FTX and investments in this industry will now be much more robust. Despite slow growth till 2025, new use cases and the evolution of technologies such as 5G internet, VR headsets, and even digital assets will accelerate the development of this industry. Metaverse Insider believes the Metaverse market size will be around 5.8 trillion by this decade’s end. Check out this article which explains our process of calculating the Metaverse Market Size.

The fate of the Metaverse Industry, including blockchain, virtual reality, and artificial intelligence remains to be seen. The future of this industry will depend on the response of the developers and investors and whether development has continued as it has over the past two years. Undoubtedly, the need for more regulation and greater control will impact the DeFi world, including decentralized metaverses such as Decentraland and The Sandbox. Digital Assets, particularly NFT projects that sold digital arts, may get a different interest than they did previously. However, this may be great for the industry in the long run as serious developers stick through the bad times and keep building while those individuals looking to make a quick buck exit the market.

If you found this article to be informative, you can explore more current Digital Twin news here exclusives, interviews, and podcasts.